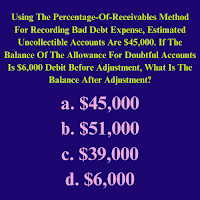

Using The Percentage-Of-Receivables Method For Recording Bad Debt Expense, Estimated Uncollectible Accounts Are

Using The Percentage-Of-Receivables Method For Recording Bad Debt Expense, Estimated Uncollectible Accounts Are $45,000. If The Balance Of The Allowance For Doubtful Accounts Is $6,000 Debit Before Adjustment, What Is The Balance After Adjustment? You May Also Be Interested In “ The Allowance For Doubtful Accounts Is A Contra Asset Account That Equals ” The correct choice is (a) as estimated uncollectible accounts are predetermind as $45,000 which is the total of uncollectible accounts’ balance which we expected not to collect from our customers for the accounting period. So, before and after Adjustment , the balance remains unchanged.