Account Receivable VS Account Payable

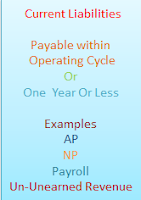

Here we study about These two Accounting Terms . Both are very important for the students of Accounting Subject. Our Main Question is That: What is the Difference Between Accounts Receivable (AR) and A ccounts Payable (AP)? Accounts Receivables or Debtors are our Current Assets of the business because we sell our products or services to our customers on Credit. For Example, if we sold goods of Rs.70000 to our Customer Mr. A, then it is a Business Transaction and Mr. A is our Customer (Account Receivable) who has to pay the amount in future date. Whereas Account Payable or Creditor is our Current Liability . It is created when we purchase our goods or services from the our suppliers or merchandisers. For Example, if we purchase goods from our suppliers Mr. B, for Rs.80000 on Credit, then it is treated as Business Transaction from the point of view of Accounting Language. Here Mr. B is our Account Payable or Creditor.