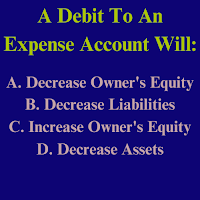

A Debit To An Expense Account Will: | Multiple Choice Question Answer

The correct answer of this multiple choice question is (A). Decrease Owner’s Equity. Brief Explanation Of MCQ Question: Expenses , (Expenses = Revenues - Profit), are incurred by the business to run the business in order to earn profits out of the profitable activities of the owner of the business. Hence, we say that expenses are related with the daily operating activities of the business. So, to run the business, expenses (Outflows Of Cash From Business) paid by the business will surely decrease Owner’s Equity but to profitable activities, the business earns profits or Revenues (Inflows Of Business) are greater than expenses. So, Expenses decrease Owner's Equity but Revenues and Profits / Income increase Owner's Equity.