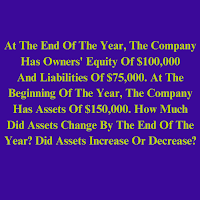

At The End Of The Year, A Corporation Has Assets Of $6,500 And Liabilities Of $2,000. How Much Is The Company's Equity At The End Of The Year?

Given: Assets at the end = $6500 Liabilities at the end = $2000 Find: Equity (E) at the end = ? As we know Accounting Equation , so we have: Assets at the end = Liabilities at the end + Equity at the end E at the end = Assets at the end - Liabilities at the end E at the end = $6500 - $2000 E at the end = $4500 So, the equity of the company at the end of the accounting period is $4,500 and at this balance of stockholders' equity, both sides (left side or assets side and right side or liabilities & equity side) o...

%20Decrease%20Assets..png)