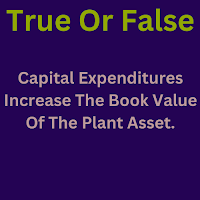

Answer True Or False: Capital Expenditures Increase The Book Value Of The Plant Asset

Solution To The Test Or Question (T/F) With An Example & Assumptions The correct answer is “True” , as Capital Expenditures (CapEx) is added to the cost of Plant Assets , so the book value or written down value of plant assets are also increased. For example, if a machinery costing $5000, having useful life of 10 years with no salvage value, are depreciated on straight line method at 10%. Then its book value for first year is calculated as shown below: (Assuming No Additional Installment Is Made) Book Value = Cost of Machinery - Accumulated Depreciation Book Value = $5000 - $500 = $4500 Here: Depreciation per year = $5000 X 10% = $500 Accumulated Depreciation = $500 If an additional installment of $1000 is made to machinery, then its cost increased to $6000 ($5000 + $1000) Now, Book Value = Cost of Machinery - Accumulated Depreciation ...