Steps in the Accounting Cycle - Example

Here we discuss about steps in the Accounting Process.

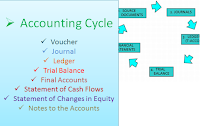

Accounting Cycle is the basic of the Accounting. The whole system

of accounting processes are operated throughout the Accounting period is called

Accounting Cycle. Every Step has its great importance. We can not ignore any

one of these. There are following steps / stages in the Accounting Cycle and we can say that the Accounting Process begins with the following Accounting Cycle Steps:

Accounting Cycle Order

1.

Voucher (Source Document)

2.

Journal (Recording)

3.

Ledger

4.

Trial Balance

5. Final Accounts (Income Statement and Balance Sheet)

6.

Cash Flow Statements

7.

Statement of Changes in Equity

8.

Notes to the accounts

1)

Voucher (source Document)

Voucher means any written evidence in support of transactions. For

example, when we sold goods to Mr. A, then we give him / her a Sale receipt for

selling goods. This receipt is called Voucher.

2)

Journal (Recording)

For Journal, Please you can referred to Journal Format for better understanding about this topic.

Recording of transactions in the books of account after verifying from the voucher or source document. For example, recording sales transactions in the Sales book after verifying from voucher receipt of the sales.

3)

Ledger

For Ledger, Please read this Ledger

After recording transactions in the journal, all theses are posted to their concerned accounts. Business Account Ledger is called the king of books of accounts.

For example, all the transactions of Sales to any person either made in cash or credit are recorded in the ledger.

After posting the transaction to concerned accounts, Accounting Trial Balance

is prepared to show the Arithmetical accuracy of the books of accounts.

Is the Total of Debit Balance equal to the Total of Credit Balance means that accounts are prepared accurately?

The answer is no, because, merely the total equality of both debit

balance and credit balance does not give us guarantee that there are no errors

or fraud in the books of accounts, so this is the limitation of Trial Balance.

For this Rectification of errors and frauds are made.

5)

Final Accounts

Final Accounts are prepared after the end of accounting period.

Final Accounts include the Income Statement (Statement of Comprehensive Income)

and Balance Sheet (Statement of Financial Position).

i. Income Statement

Income Statement

shows us financial performance (Net Income) of the business.

ii. Balance Sheet

Balance Sheet shows

us financial position of the business.

6)

Cash Flows Statements

Cash Flows

Statement shows us Cash inflow and Cash outflow of the business. It shows the

Liquidity position of the company.

Note: You may also be interested in Statement of Cash Flows Example

Note: You may also be interested in Statement of Cash Flows Example

There are three

components of this statement:

i. Operating Activities

Operating activities include those Cash Transactions that are

important for the operations of the business. Revenues and Expenses and Working

Capital are example.

ii. Investing Activities

Cash involves

in investing related transaction, Purchase of Fixed Assets, Disposal of Fixed

Assets and Cash investments.

iii. Financial Activities

Cash Flows

involve the financial related activities like Cash received from issuance of

capital, Cash Dividend, Repayment of debts.

Changes in

Equity are recorded in this account. Retained Earnings, Share Capital, General

Reserves, are transferred to this statement.

These notes are

provided for the necessary explanation of the accounting transaction For

example, we provide the detail of contingent liability (that depends on the

happening of certain event) in Notes to the accounts section.

So, hopefully now you

can understand the above mentioned steps in the Accounting Cycle that are explained

through example.

Comments