Current Liabilities Definition And Examples

We already familiar with Current Liabilities in our previous articles but here

we discuss them in more details and explain them with important examples.

We already familiar with Current Liabilities in our previous articles but here

we discuss them in more details and explain them with important examples.Current Liabilities Definition:

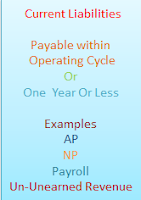

These are the liabilities that are

paid out for the current Accounting Period of time or with the total period of

one year.

Types of Current Liabilities / Examples of Current Liabilities

Here are most important examples

of Current Liabilities.

From time to time, businesses may

purchase goods from suppliers on Credit basis for resale purposes. They are

also called Creditors. Accounts Payable sells goods on credit to those

companies that can repay their credit amount in time. So, they check their

Working Capital through Financial Statements. The suppliers can give discount

to these companies on sale.

Accounts Payable includes Trade Accounts and

Other Accounts Payable. Trade Accounts Payable give credit during trading or in

case of Inventory or merchandise. For Example, getting credit on buying goods

or services. Other Accounts Payable may include those persons that can give you

Credit other than Inventory or merchandise. For Example, Expenses Payable, Rent

Payable, etc.

· Notes Payable

So, it is all about Current Liability Definition and

its Examples and we can say that it is very necessary for the business to

monitor it in order to improve the working capital of the business and

ultimately to run the business smoothly.

What Are Notes Payable?

Notes Payable Definition:

Examples include Bank Loans, Purchase of

Costly Office Equipment, Purchase of Inventory or merchandise, etc.

· The Current Portion of Long-Term

Debt

It includes short-term borrowings

like taking loans from banks for mortgage property. The current portion of loan

is the principal amount that is payable on monthly, quarterly, Semi-Annually

and Annual Basis. This Current portion is treated as Current Liability.

When expenses are not paid but the

benefits are attained for its utilization. Examples include Salaries Payable, Telephone Expenses,

Utility Bills, etc.

As we do not make payment for our

expenses, so these expenses are also called Accrued Expenses.

· Payroll Liabilities

An Entrepreneur not only pays salaries, wages to

its employees but also pay any benefit provided under the law. Payroll includes

wages, salaries and other costs required by law.

Payroll includes:

Rs.

+ Salaries + Wages 100000

+ Social Security

And Medical Relief 7000

+ Federal Taxes 5000

+ Unemployment Taxes 3000

+ Workers

Compensations 2000

________

Total Payroll Costs 117000

________

It is the Revenue which

is actually not earned by the entrepreneur but the amount of payment is

received from the customer.

In Other words, we can say that the amount

received from the customers for the services not actually rendered by the

business. In this case, the company receives the fees in advance. Now it is the

Current Liability of the company to render the services in the future period of

time because it is done within the operating cycle of the business.

Comments