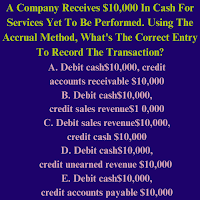

A Company Receives $10,000 In Cash For Services Yet To Be Performed. Using The Accrual Method, What's The Correct Entry To Record The Transaction?

The correct answer of this Multiple Choice Question is (D), as the company / corporation received $10,000 for cash from clients in advance and still the services against the amount received

are not performed. As the services are not rendered to clients, so the company yet to be earned revenue. So, unearned revenue account is created. Under Accrual Basis of Accounting, we record a Business Transaction whether the cash is received or not. So, we debit cash account of $10,000 and credit Unearned Revenue Account of $10,000.

Cash of $10,000 is received in advance against the services which are still not be performed, so we create a second account which is Unearned Revenue of $10,000. As cash is increasing as it is coming into the business, so we debit it and credit Unearned Revenue Account as a Liability because now the company is liable to perform services against the cash received in advance. So the liability of the company to perform services is increasing, so credit unearned revenue account according to the Rules of Debit and Credit.

Under accrual basis of accounting, we record revenue only when it is earned by the company, so we record unearned revenue account which is a liability for the company to perform the services to the clients against the advance payment received from them. When the company actually rendered the services, then we debit unearned revenue account and credit the relevant revenue account for the accounting period.

Comments