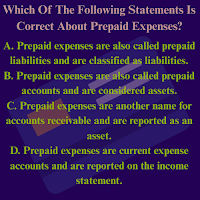

Which Of The Following Statements Is Correct About Prepaid Expenses?

The option (B) is incorrect choice as PE are not prepaid liabilities and

categorized as liabilities.

The option (C) is also wrong choice here as PE are not Accounts Receivable.

PE are not receivables i.e., the amount of due to be received from customers

for goods sold or services rendered on account, but the probable benefits to be

received in near future from the utilization of prepaid asset.

The option (D) is also wrong choice here as PE are not current expense accounts which are recorded in the Income Statement for the period. The difference between prepaid expenses and Expenses is that in PE the benefits will be received in near future but the payment is paid in advance so it is treated as unexpired asset while in expenses, the benefits will be received immediately and the payment is made later on such as electricity expense, rent expense, etc., where benefit be enjoyed immediately but the payment is made later on.

Comments