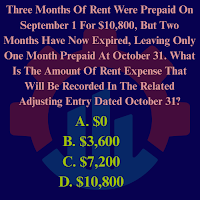

Three Months Of Rent Were Prepaid On September 1 For $10,800, But Two Months Have Now Expired, Leaving Only One Month Prepaid At October 31. What Is The Amount Of Rent Expense That Will Be Recorded In The Related Adjusting Entry Dated October 31?

Explanation:

Rent (R) for 1 Month = Total Amount of R / 3 = $10,800 / 3 = $3,600

Here, we need to find out RE for 2 months from 1st September to 31st

October, so

RE for 2 months = $3,600 X 2 = $7,20

So, the amount of $7,200 of RE will be recorded in the adjusting entry on

31st October, which is shown below:

RE a/c $7,200

PR $7,200

(The portion of Prepaid Rent (PR) Which Had Expired Is Transferred To RE

Account)

Initially, when the R is prepaid i.e., not expired on 1st September

and we paid advance rent, then, we record the following entry on 31st

October, as shown below:

PR a/c $10,800

Cash a/c

$10,800

(R Paid In Advance For Three Months)

On 31st October, as we received the benefits of rent of the monetary

value of $7,200 for 2 months by using office building, so deduct this portion

from the total prepaid amount ($10,800) of rent. The remaining balance of $3,600

is carried down to the next month, November. Also, on 31st October,

the expired portion of PR ($7,200) is charged to RE account.

The ending balance of PR an on 31st October is $3,600 while

total rent expired charged to RE account as shown in the following T-Accounts:

PR T-Account

For Two Months (September And October)

Date $ Date $

Sep. 1 Cash 10,800 Oct. 31

Rent 7,200

Oct. 31 Balance c/d 3,600

_______ ________

Total

10,800 Total 10,800

________ _________

________ _________

RE T-Account

For Two Moths (September And October)

Date $ Date $

Oct. 31 PR

7,200 Oct.

31 Balance c/d 7,200

_______

_______

Total

7,200 Total 7,200

________ ________

________

________

The other options A, B and D are incorrect choices of this mcq.

Comments