What is a transaction– Explanation

Any

event that takes place between two or more persons or things and that event

affects the financial position of the business and also that event must be

expressed in terms of money, then we can say that the transaction is occurred

in the business.

Any

event that takes place between two or more persons or things and that event

affects the financial position of the business and also that event must be

expressed in terms of money, then we can say that the transaction is occurred

in the business.

Explanation: From

the definition, we must consider the following terms in order to understand the

definition of transaction:

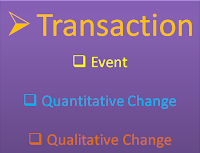

1. Event

Event means "Anything that

happens". There are two types of events:

1. Monetary

Events

Those

events that involve the use of money and that event can change the financial

position of the business. Examples of such are transportation expenses, ceremonial

expenses, etc.

2. Non-Monetary Eve

Such

events which do not involve the use of money and that events do not change the

financial position of the business are called Non-Monetary Events. Examples are

delivering the speech, Dancing, etc.

But

in Accounting Event has

special meaning. In Accounting only those events are considered that are

related to money and that change the financial position of the business. So,

only those Monetary Events are recorded in the books of accounts which can

change the financial position of the business.

Three Important Examples to understand Transactions.

1. Exchange of

Things between two persons but not treated as Transaction

Mr.

A (Seller) gives a list of price to Mr. B (Buyer), then Mr. B returns it to Mr.

A. This involves exchange of things between two persons. Mr. B receives the price

list and Mr. A receive price list after seeing and reading price list gives it

to Mr. A. But this exchange does not treated as transaction as this is not

monetary transactions and it can not change the financial position of the

business.

2. No Exchange

but treated as Transaction

When

goods worth Rs.10,000 are destroyed by fire or goods damaged or goods lost by

theft, then there is a transaction taken place, because it is measurable in

terms of money and it changes the financial position of the business, even though

there is no exchange.

3. Event is

monetary but not Transaction

Mr.

A (Supplier) receives an order for the supply of Goods worth Rs. 50,000 from

the buyer Mr. B. This order is expressed in term of money but it is not treated

as transaction as it is only an intimation to purchase the goods and it does

not change the financial position of the business. After the receipt of order,

if Mr. B purchases the goods, then it is treated as transaction.

Results:

From the above Explanation, we

conclude that in Accounting Transaction takes place only when following two

conditions are fulfilled:

1. The Event must be expressed in

terms of money.

2. The Event must change the

financial position of the business.

Characteristics

/ Features of An Event:

1. Two Persons

/ Things

For

a transaction to take place there must be at least two persons or things. One

person receives and other person gives something.

For

Example, Mr. A sold goods for Cash Rs.40,000 to Mr. B, then there is

transaction as Mr. A gives goods and receives Cash from Mr. B.

2.

Event should be measurable in terms of Money. For Example, Mr. A sold goods for

Cash Rs.40,000 to Mr. B can be expressed in terms of money i.e. Rs.40,000 is

expressed in terms of money, so it is a transaction.

3.

Transfer of Property or service from one person to another. For Example, Mr. A

Sold goods for Cash Rs.60,000 to Mr. B, then there is transfer of property

(goods) from Mr. A to Mr. B. Similarly, if we pay salaries to our employees for

the services they rendered for our business, then there is transfer of service

from our employees to our business.

4.

Event should change the financial position of the business. The change in

financial position of business is taken place in the following two ways:

(i) Quantitative Change

(ii) Qualitative Change

(i) Quantitative Change

It

means changing in the value of assets and equity. Suppose, The goods worth Rs.30,000

are destroyed by

fire, then the value of Closing Stock decreases and as a result, the total

value of assets in the assets are decreased and financial position of the

business is also declined. So, there is a quantitative change in the financial

position of the business.

(ii) Qualitative Change

Under this change, the total value

of assets and equity remains same, but the value of different elements of

assets and equity is changed.

For Example, When we purchase Furniture from

our supplier for Rs.50,000, then the total value on both sides of Balance Sheet

remains same but the value of assets on Assets side is increased by Rs.50,000

and the value of liabilities on Liabilities& Owner's Equity is also

increased. Hence there is a qualitative change in the financial position of the

business.

Comments