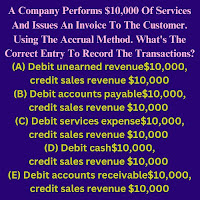

A Company Performs $10,000 Of Services And Issues An Invoice To The Customer. Using The Accrual Method. What's The Correct Entry To Record The Transactions?

Answer Of MCQs

The Correct Answer of this multiple choice question is (E) as under Accrual Basis of Accounting, we record Revenue when it is earned by the company whether the cash is received or not during the accounting period. As the company performed the services to the customer, so the company earned the revenue. So, we debit Accounts Receivable Account with an amount of $10,000 as the amount of revenue not yet received by the company from the customer and credit Sales Revenue Account.

You May Also Be Interested In "A Company Receives $10,000 In Cash For Services Yet To Be Performed. Using The Accrual Method, What's The Correct Entry To Record The Transaction"?

Under Accrual Basis of Accounting, we record the transaction whether the cash is involved or not. That is why we record both types of transactions i.e., cash transactions and credit transactions. Due to this, we create accounts receivable, accounts payable, sales on account, purchases on account, etc. Later on when the cash is actually received or paid we adjust the value of relevant accounts such as we update the value of accounts receivable when cash collected from customers. For example, when Sales are made on account, then sales as a revenue is recorded eventhough cash is not received. Instead of cash we create accounts receivable account as the amount of sales is receivable from customers for goods sold or services rendered. When the company actually received cash, then credit accounts receivable account and debit cash account. Now the resulted entry is cash account is debited and sales account is credited in the books of account.

Accrual basis of accounting emphasizes on the matching principle which states that the revenue earned for the accounting must be matched with all of the expenses incurred in earning that revenue for the period. This shows the true, accurate and fair position of financial statement.

Comments