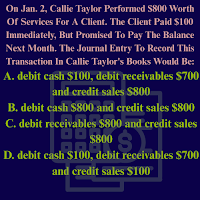

On Jan. 2, Callie Taylor Performed $800 Worth Of Services For A Client. The Client Paid $100 Immediately, But Promised To Pay The Balance Next Month. The Journal Entry To Record This Transaction In Callie Taylor's Books Would Be:

When the Callie Taylor performed the services worth $800, then the business

earned the revenue whether the cash is received or not according to Accrual

Basis of Accounting. Here, the client paid $100 in cash and promised to pay

the remaining $700 ($800 - $100) on the next month is a receivables for the Callie

Taylor’s business, which is a current asset and shown on balance sheet under

assets side.

As the business received partially in cash against the services performed,

so we record the following journal entry in the Books

of Accounts of Callie Taylor’s business:

(i)

Cash a/c $100

Sales a/c $100

(Cash Sales Made On 2nd January)

In the above entry, the cash is debited as it is received by the business

of Callie Taylor’s company, so it is increasing and sales is also increasing, as

the business is performed the services and earned the revenue, so it is

credited.

The remaining amount shows receivables i.e., services are performed but the

payment is not received from client, so the following entry is recorded as

shown below:

(ii)

Accounts Receivable a/c $700

Sales a/c $700

(Sales Made On Account / Credit On 2nd January)

In the above entry, accounts receivable is debited as it is increasing and

sales is also credited as it is increasing.

If we join these (i) and (ii) two entries, we get one combined entry as shown below:

Cash a/c $100

Accounts Receivable a/c $700

Sales a/c $800

(Sales Made For Cash And On Account On 2nd January)

So, we record either two entries separately i.e., one for cash and other

one for credit or one single combined entry, the result will be the same.

So, the correct answer of this multiple choice question is A.

The other options (B,C and D) are wrong choices here.

Comments